Keeping customers is a less expensive process than finding new customers, but that doesn’t mean it’s easy. Companies have to put real effort in to creating ongoing value for their customers.

Sometimes, even if a company does everything right, customers may still leave because of cost pressures, because a new administration wants to work with different suppliers, or any other number of reasons.

Let’s take a look at some pressures your customers may be feeling, how to be on the look out for attrition, and then what we can do about it all. It’s never something we can fully control, but we can influence the outcome.

Consumer / Patient Pressures

While not all medtech companies are selling directly to patients or consumers, the state of the individual certainly impacts how health systems are doing. If patients are delaying care for any reason, then hospitals feel the impact.

We are likely all aware of the impact inflation has had on household expenses. We’ve seen costs go up, and not all workers are seeing commensurate compensation increases. Obviously, this puts pressure on households—especially those with less discretionary income.

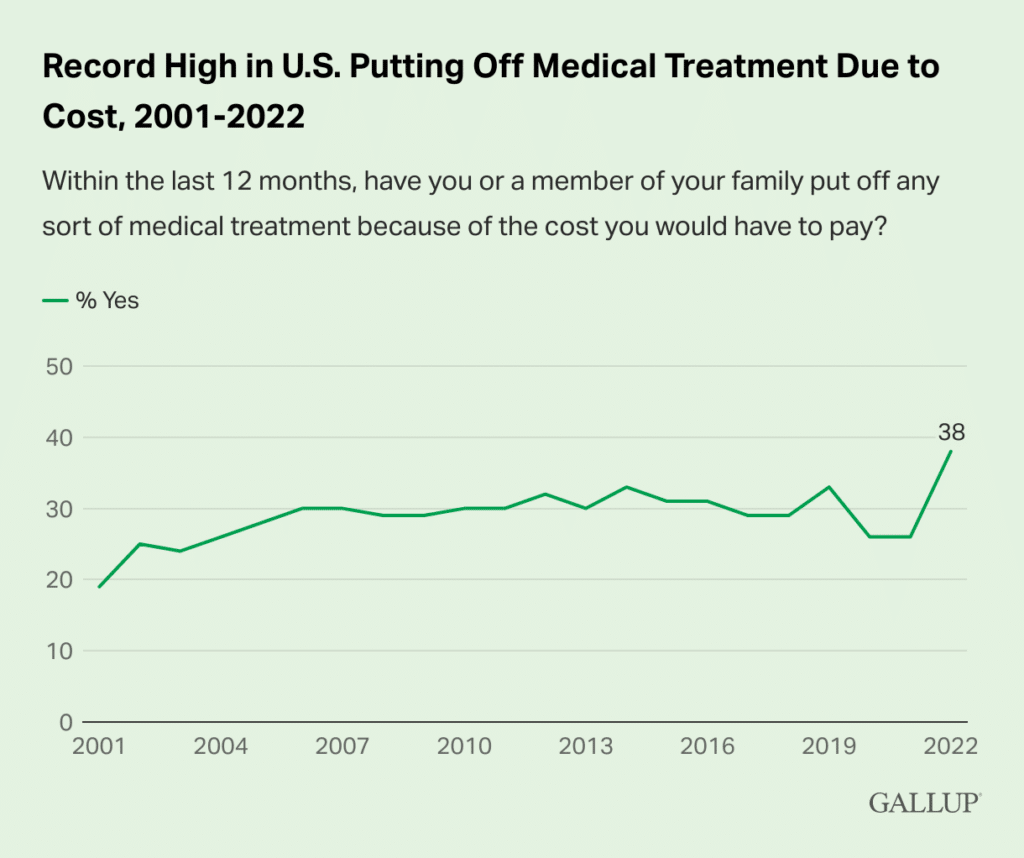

While the cost of healthcare is always a strong factor for consideration, the need to delay treatment has grown. Gallup published a poll at the beginning of this year to show that more Americans delayed medical care due to cost in 2022 than ever before.

My initial reaction to this kind of information is that people must have decided to put off low-urgency types of conditions. If the discomfort wasn’t that bad, then maybe people could put up with it for longer while they waited for their finances to rebound.

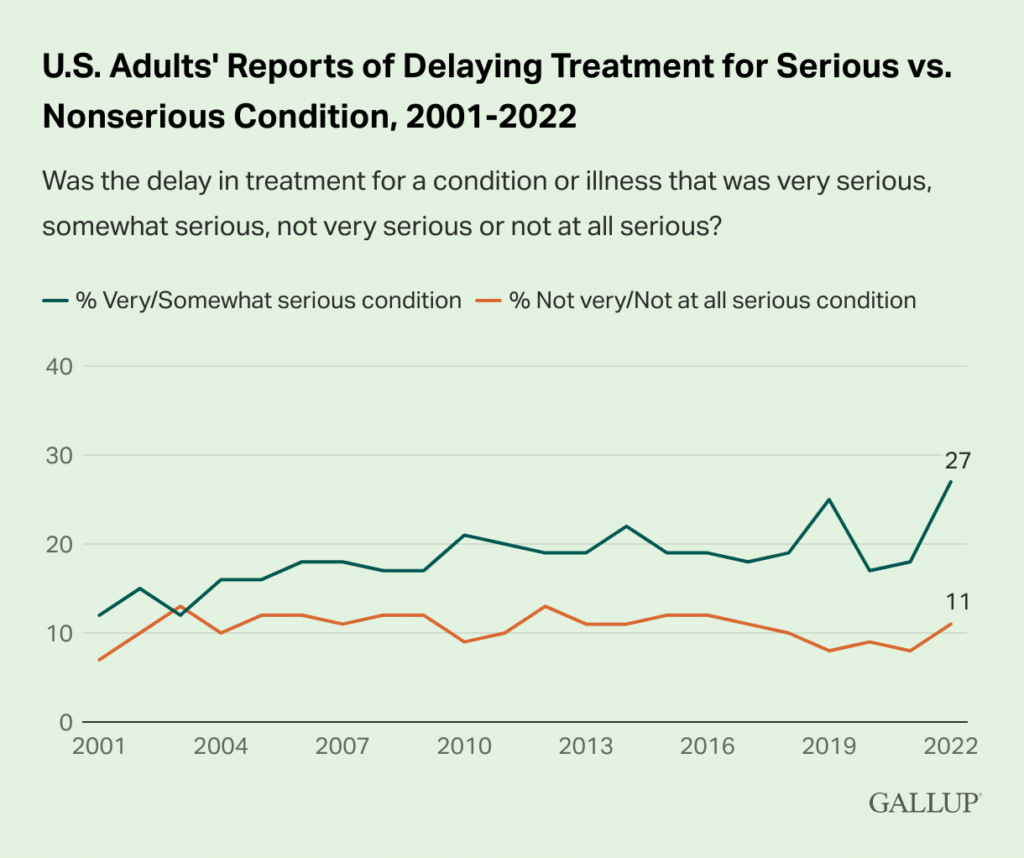

That wasn’t really the case. While delaying treatment for “not very” or “not at all serious” conditions remained relatively in line with previous reported years, the delay in “very” or “somewhat serious” conditions spiked in 2022.

One thing to note about the above chart from Gallup is that the delay in “very” or “somewhat serious” conditions may have dipped more due to Covid concerns than cost. Patients were already facing financial pressures in 2019—but not to the same degree as we saw in 2022.

So, yeah, patients changed their behavior. What does that mean for health systems? Obviously, it’s connected, but what are the specifics?

For that answer, we can turn to a report from Kaufman Hall.

Hospital Pressures

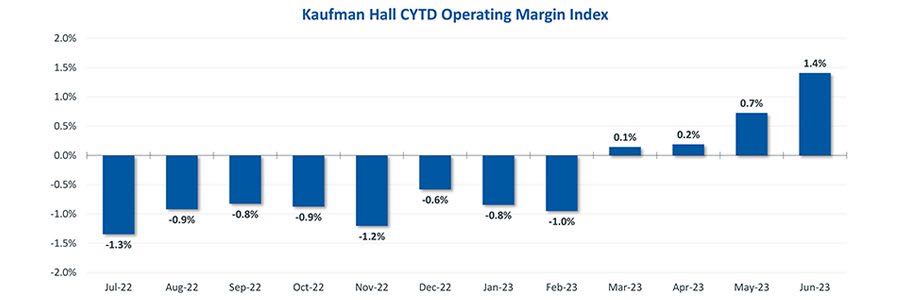

Kaufman Hall publish a monthly report to show how the calendar year-to-date operating margins look for hospitals. In July’s report, you can see that things are finally starting to improve. June looked great!

But 2022 and even the first quarter of ’23 looked pretty rough.

Kaufman Hall reports that though the data looks good on the chart, “fiscal year-end accounting adjustments” may have helped provide the boost. Supplies and expenses are still high, and hospitals are operating on narrow margins.

MSN recently published a report on HCA Healthcare’s improving profits while still remaining cautious about what the news could mean for the rest of the year. The long-expected return of patients means more procedures, but there are also more expenses required to complete those procedures.

When profits are so low, hospitals have to reevaluate every expense—even on their most profitable procedures. Hospitals may focus more on which suppliers can give them the lowest rates. Costs, of course, still have to be balanced with outcomes.

Overall, there is room for optimism, but patients, providers, and medtech companies are all recovering at different rates. It’s certainly not a time to push aside financial concerns.

With hospitals and patients watching their every dime, medtech companies need to be on the watch for declining revenue. There are certainly some events outside of our control, but what can we do to serve our customers as best as we can?

On the Watch for Attrition

If we want to fight to keep our customers, we first need to know the signs.

Over the last three to six months, why have customers left? How many customers have left? Can we establish an attrition rate?

Consulting firm Atrium writes that we need to know what attrition trends emerge.

- Do customers begin using your product(s) less frequently?

- Do they login to online systems less?

- Does the size of their orders begin to shrink?

Or, can you not determine any trends in customer behavior? It may be that usage and purchasing stays at the same rate until the day it suddenly turns off.

We talked about using available data to retain your customers in “From Product Experience Stats to Satisfaction: Optimize for Retention,” but you may not always have timely stats to help you.

Fighting Against Attrition

Ideally, your company would always have enormous R&D and marketing budgets to help you continue innovating and outmaneuvering your competition. After all, products that deliver superior results are going to be the easiest to market.

In reality, that sort of success in innovation is an elusive target, and it’s likely not a factor you can control.

So where can you start?

Messaging

You need messaging that will help reduce any sort of buyer’s remorse and remind customers of your device’s potential.

Success and Troubleshooting

As you talk about the many success stories of your customers and product, be sure to offer support and troubleshooting for people that aren’t seeing the same results. Perhaps a salesperson can help a hospital with an admin issue. Maybe customer support can help a customer hone in on the correct settings for their situation.

You want to establish that the “norm” of using your product is success, and you can help your customers achieve that same state. For every success story you share, be sure to offer your contact information again for the specific purpose of improving results.

Previews of New Features

You can keep customers looking forward to what’s next by continuing to show off innovation, if it’s available. Reassure them that you’re committed to seeing this product only continue to grow in usefulness.

This type of communication can be especially beneficial to tampering the effect of competitor advertisements. If your product is keeping up in the race to add new features, then there’s no reason for a customer to go through all the pain of switching to a competitor or adding another device to the mix. Microsoft has been riding this approach to its Office offerings for years now.

Information from Key Opinion Leaders + Best Practices

People trust real people. You already know this, so I won’t belabor this point.

The more your expert customers / key opinion leaders can demonstrate successful ways of using the product, the more people are going to see that your messaging isn’t just hype.

Tools to Evaluate ROI for Hospitals and Practices

This suggestion gets tricky very quickly, but let’s clarify that I’m talking about ROI in both a clinical and a financial sense. We want to demonstrate that yours is the right solution for physicians and administrators.

Calculators

Perhaps you can give access to a simple online calculator that lets customers enter in some basic info about the number of procedures performed with your device or technology, and you can share expected cost savings.

Or, perhaps, you can look at national averages of complications compared to what customers are seeing with your technology.

These types of tools don’t convey concrete proof, but they give a hospital a benchmark to use as they review their data.

It’s a good first step to showing what’s possible.

Matching Patient Data against Procedures

Perhaps you can provide a way of combining a hospital’s outcomes with information about procedures performed with your device. This approach requires a lengthy period of review for legal and security teams, but it’s certainly possible. I’ve had conversations in just the past few weeks about various companies that can supply de-identified data from EHRs.

Some health systems will be able to perform this type of analysis on their own, of course, but you can’t expect all hospitals and practices to have those types of sophisticated systems in place.

Medtech companies can be the ones to match up a procedure along with the health and financial outcomes. Putting that information together is a double-edged sword. Yes, it can conclusively demonstrate that you and your device are benefitting the hospital and patients, but it can also reveal weaknesses in your results, as well.

Companies would certainly benefit from taking a pilot plan approach to identify issues and solutions rapidly before rolling out a connected plan to everyone at once.

One way to test the process and identify outcomes is to work with a physician or hospital to manually compile this info. Either a sales rep can work with someone in the office, or external groups can get access to the EHR to perform an analysis on their behalf—keeping you from having to go through all the issues with having to get the necessary clearance.

Regardless of the data-gathering mechanism, you may need more than one type of reporting or dashboard to meet the needs of your various audiences. Physicians are looking for very different data than administrators. Procedure efficiency and timing won’t mean as much as outcomes and operating margins to the C-suite.

You can’t take a one-size-fits-all approach.

Open Dialogue

At the end of the day, the specific message and/or toolset chosen is less important than an ongoing conversation with your customer to understand their needs and adapt accordingly.

I recently had the chance to hear about the ways medtech companies are taking innovative approaches to channeling customer feedback into marketing campaigns at the MedDev eMarketing Summit. One of the most interesting things I picked up at the event was the constant reinforcement that companies need to consider all the stakeholders that go into purchasing and using any new device or system. Yes, the C-suite and the physician matter, but so do the nurses and the people doing the purchasing.

How can you best demonstrate the value and return on investment for each of these critical stakeholders?

The companies that figure out the answers for each group—through a process of careful listening and providing solutions—will be the ones to beat out the competition.

Michael spends a great deal of time with the healthcare industry both professionally and personally, which gives him the perspective of what stakeholders on either side of the care equation need.

He began coding in 2008 and subsequently shifted his attention entirely to online marketing. Michael completed his MBA in 2018, focusing on the intersection of healthcare and marketing.